Best Crypto Trading Simulators for New Traders

.png)

Crypto doesn’t ease you in.

Markets rarely give beginners time to learn safely.

Bitcoin can move hundreds of dollars in minutes. Altcoins can spike or collapse without warning.

Liquidity shifts quickly. Sentiment flips faster.

For new traders, that speed turns small execution errors into large losses.

Most beginners don’t lose because they’re careless or unintelligent. They lose because they’re learning in real time with real capital. Every mistake has financial consequences, which adds pressure and distorts decision-making.

A crypto trading simulator removes the financial damage while keeping the decision-making intact. Modern replay-based platforms like FX Replay are designed specifically for this kind of deliberate practice and realistic market simulation.

You still:

- Read price action

- Choose entries and exits

- Manage risk

- Sit through volatility

The difference is simple: mistakes become feedback instead of losses.

This is why many traders choose to practice trading without risk before going live.

Simulation isn’t about hiding from risk. It’s about building familiarity before consequences matter.

Pro Tip:

If you’re learning crypto with real money on day one, you’re paying tuition. Simulation lets you learn first, and pay later only if you choose to.

What a Crypto Trading Simulator Actually Is (And Isn’t)

.png)

A crypto trading simulator mirrors real market behavior using live or historical data. Trades are executed with virtual funds, but the mechanics of trading remain realistic.

You learn:

- How market orders behave in volatility

- How limit orders fill (or don’t)

- How spreads affect execution

- How price accelerates during momentum

But here’s what matters: realism varies dramatically between platforms.

Some simulators are little more than paper trading dashboards. Others, like FX Replay, allow traders to replay historical crypto markets candle by candle, pause, rewind, adjust execution speed, and review trades directly on the chart.

The difference between basic paper trading and realistic replay simulation determines how transferable your results actually are.

A simulator is designed to:

- Teach execution mechanics

- Build familiarity with volatility

- Allow structured strategy testing

- Strengthen discipline

It is not designed to:

- Guarantee profitability

- Remove emotional pressure permanently

- Replace live trading entirely

Pro Tip:

If your simulator feels too easy, it probably isn’t realistic enough.

Why Simulators Matter Even More in Crypto

.png)

Crypto amplifies everything.

- Volatility is sharper

- News impact is faster

- Liquidity changes are abrupt

- Sentiment shifts are extreme

Fear escalates quickly. Greed accelerates even faster.

This is why serious traders don’t just “try crypto” live. They rehearse.

Simulation allows repeated exposure to:

- Fake breakouts

- Liquidation cascades

- Extended trend moves

- Low-liquidity whipsaws

With replay-based platforms like FX Replay, you don’t wait months for these events. You can replay them repeatedly and compress years of market exposure into structured practice.

That repetition is what builds pattern recognition.

Many experienced traders continue using simulators daily for this exact reason. Repetition sharpens execution faster than occasional live exposure ever could. The benefits of structured, consistent simulator practice compound over time.

Pro Tip:

The first time you see a liquidation cascade shouldn’t be with real money on the line.

What to Look for in a Crypto Trading Simulator

Not all simulators are built for learning. Some are built for engagement.

Traders comparing different platforms often focus on surface features instead of training depth.

If your goal is skill development, look for:

- Real historical market data

- Accurate execution modeling

- Ability to replay past sessions

- Multi-timeframe flexibility

- Performance analytics

- Integrated journaling

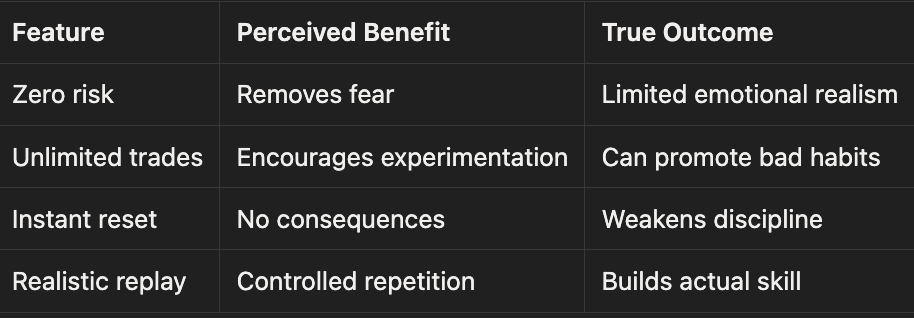

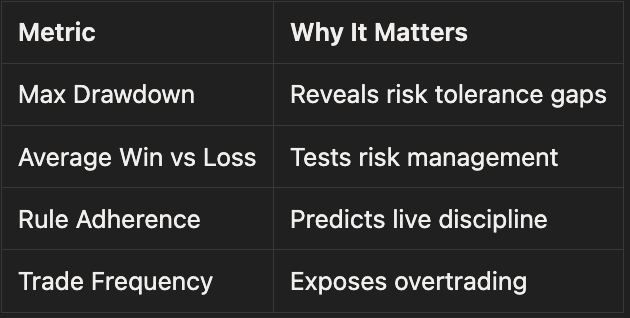

Simulator Appeal vs Training Reality

Realistic data matters more than flashy dashboards.

Crypto does not move smoothly.

It consolidates, spikes, stalls, and reverses violently. Your simulator should reflect that behavior.

Pro Tip:

If the price feed looks smoother than real crypto charts, your expectations are being trained incorrectly.

How New Traders Should Actually Use a Crypto Simulator

Most beginners misuse simulators.

They:

- Oversize positions

- Trade randomly

- Switch strategies constantly

- Chase virtual profits

That trains the wrong instincts.

Instead, simulation should be structured.

Start with:

- A defined trading plan

- Fixed risk per trade

- Realistic account size

- Clear entry/exit logic

Trade the same capital you plan to use live.

If you want to understand how serious traders run simulator sessions, follow a disciplined workflow instead of experimenting randomly.

Most importantly, review your trades.

Many traders underestimate the value of structured trade journaling. Platforms like FX Replay combine replay and journaling, so you can review trades directly on the chart, tag them by setup type, filter them by mistake category, and analyze them in context instead of relying only on spreadsheets.

This is where real improvement begins.

Tracking Progress the Right Way

Simulator profits are misleading.

A few favorable moves can create confidence that isn’t supported by consistency.

Instead of focusing on profit, ask:

- Did I follow my rules?

- Was my risk consistent?

- Were losses controlled?

- Did I repeat the same mistake?

This is why combining replay with structured backtesting provides a clearer picture of strategy quality versus execution errors.

Metrics That Actually Matter

If execution isn’t stable, profit doesn’t matter.

Pro Tip:

A smooth equity curve built on broken rules is a delayed disaster.

Common Crypto Simulator Mistakes to Avoid

Even disciplined traders fall into these traps:

1. Overtrading

With no real penalty, traders often take far more setups than they would in live markets.

2. Ignoring Context

Crypto reacts quickly to sentiment and liquidity shifts. Practicing without factoring in context creates dangerous blind spots.

3. Assuming Simulator Success Guarantees Live Success

Simulation prepares your process, but it does not build emotional resilience.

If you want to correct bad trading habits before they cost real money, simulation is where that work should happen.

Transitioning From Simulation to Live Crypto Trading

The move to live trading should never be abrupt.

Even traders who perform well in simulation feel emotional intensity increase once real capital is involved. That shift surprises most beginners.

A healthy transition looks like this:

- Reduce position size

- Keep the same rules

- Accept emotional friction

- Continue reviewing trades

Many traders preparing for structured evaluations or prop-style environments rehearse those conditions in simulation first, building rule consistency before real performance metrics matter.

Pro Tip:

If your heart rate spikes dramatically when you go live, reduce your position size.

What Separates Professional-Grade Simulators From Basic Paper Trading

Most crypto simulators introduce mechanics.

You click buy. You click sell. You watch a balance change.

That’s surface-level exposure.

FX Replay approaches simulation differently.

Instead of reacting randomly to live price, traders can:

- Replay real historical crypto markets candle by candle

- Pause, rewind, or accelerate time

- Jump directly into volatile sessions

- Practice specific setups repeatedly

- Review executions directly on the chart

This shifts simulation from passive observation to deliberate practice.

Replay, execution, and journaling exist inside one unified workflow.

Trades aren’t just logged. They’re analyzed in context.

In high-volatility crypto environments, this is critical. Small timing errors become amplified. Reviewing them directly on the chart, rather than just looking at profit numbers, makes correction faster and clearer.

This level of realism is why replay-based simulation has become a core training tool for many serious traders.

If your goal is preparation and process development, FX Replay fills the gap generic crypto simulators leave behind.

Pro Tip:

If you can’t replay the mistake and explain it clearly, you’ll repeat it.

Final Thoughts

Crypto trading simulators aren’t about finding winning trades.

They’re about learning how trading actually works.

For new traders, simulation builds:

- Familiarity

- Discipline

- Execution clarity

- Realistic expectations

When evaluating a simulator, prioritize realism, replay capability, and structured review tools. These features often determine how quickly trading skills develop.

Practice first. Understand your behavior. Then risk capital

They allow traders to practice buying and selling cryptocurrencies using virtual funds under real market conditions.

Many offer free access with limited features. Advanced tools often include deeper analytics and replay functionality.

Realism depends on the platform. The most effective simulators use real historical data and accurate execution modeling.

Yes. They allow traders to test ideas across different market environments without financial risk.

After demonstrating consistent execution, controlled risk, and rule adherence in simulation.