.png)

Nvidia Anchored VWAP Strategy

December 13, 2025

By

Brian Shannon

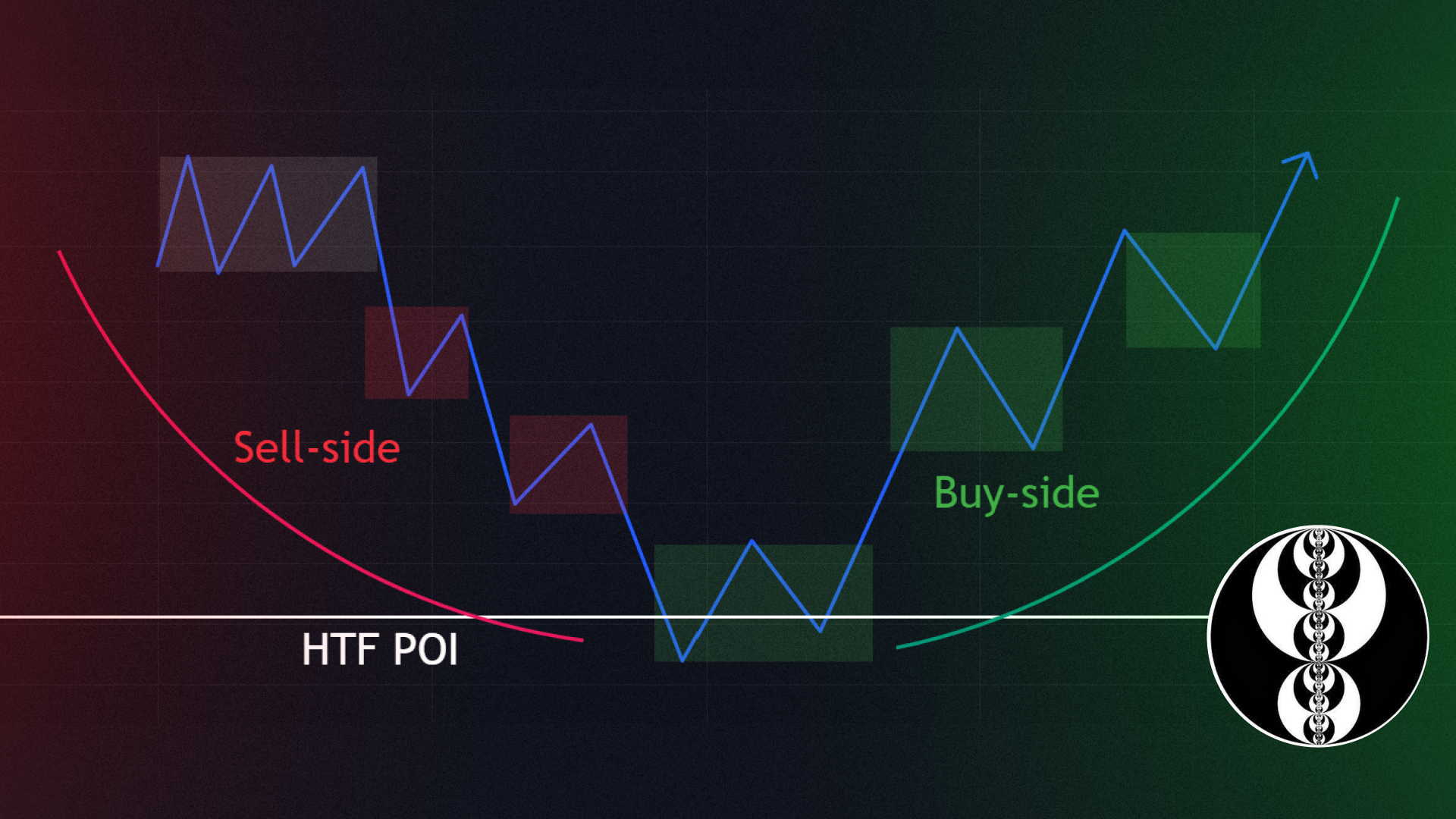

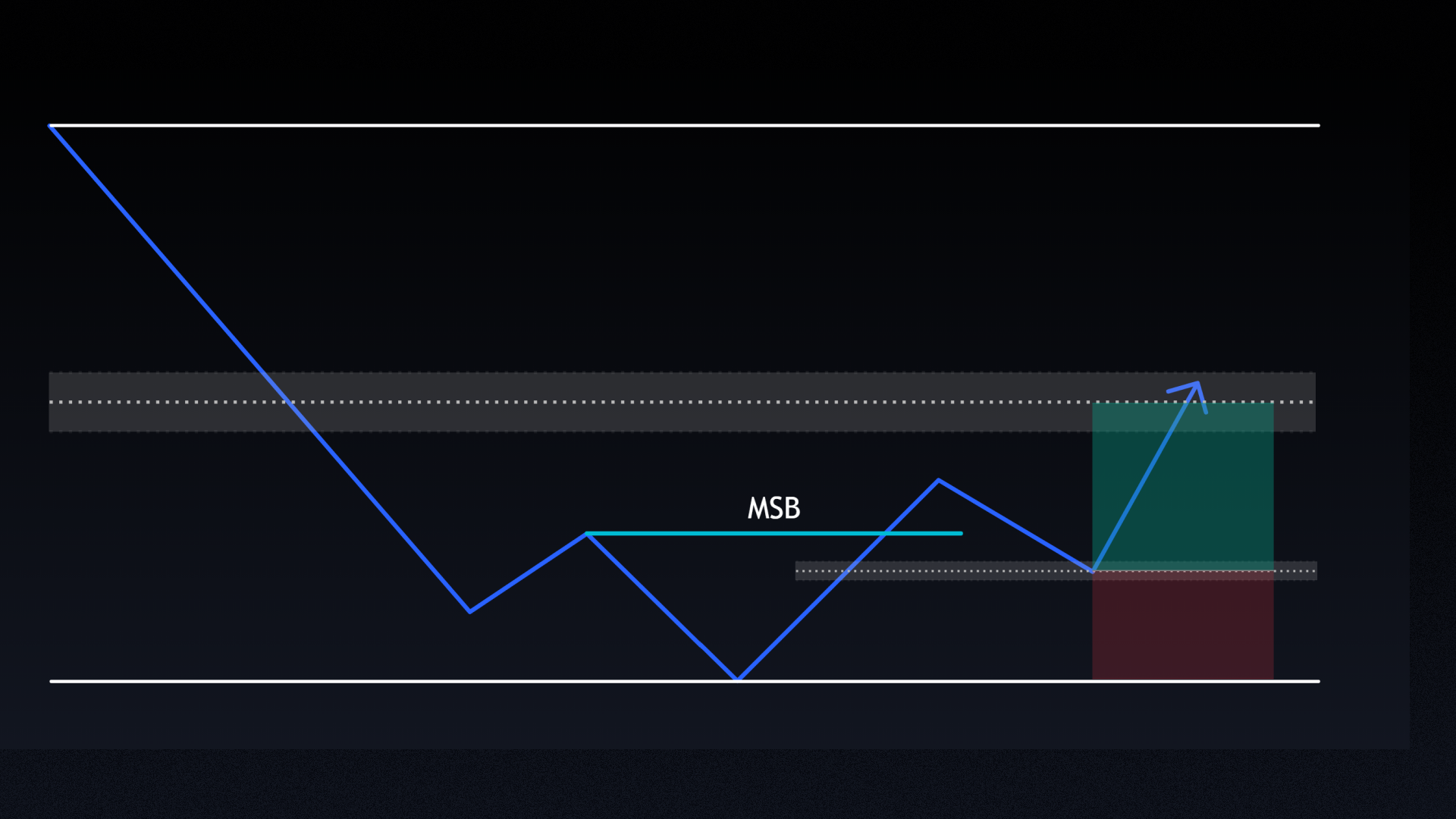

This stock strategy combines Anchored VWAPs (AVWAPs) with 2-minute market structure breaks (MSBs) to create a structured intraday trading plan. Traders plot AVWAPs from significant points—such as earnings, major highs/lows, or breakouts—on a 30-minute chart. Once price retests one of these anchored levels, traders drop to a 2-minute chart and wait for a market structure break to confirm entry. After entry place stop loss at recent or retest high/low, targeting fixed 1.5R or trailing stops to new high/low of day or opposing VWAP.

The system is designed for disciplined, data-driven execution. It discourages trades between tightly packed AVWAPs, and encourages journaling tags like AVWAP type, direction of retest, and recent price gaps to optimize performance. The goal is to focus on A+ setups only—those that meet all criteria—while managing risk with clarity. This structured, repeatable framework is ideal for building confidence and refining execution through consistent backtesting.

Other strategies

By

ICT

By

Tomtrades