.png)

Fibonacci Retracement Forex Swing Trading Strategy

September 20, 2025

By

Ara

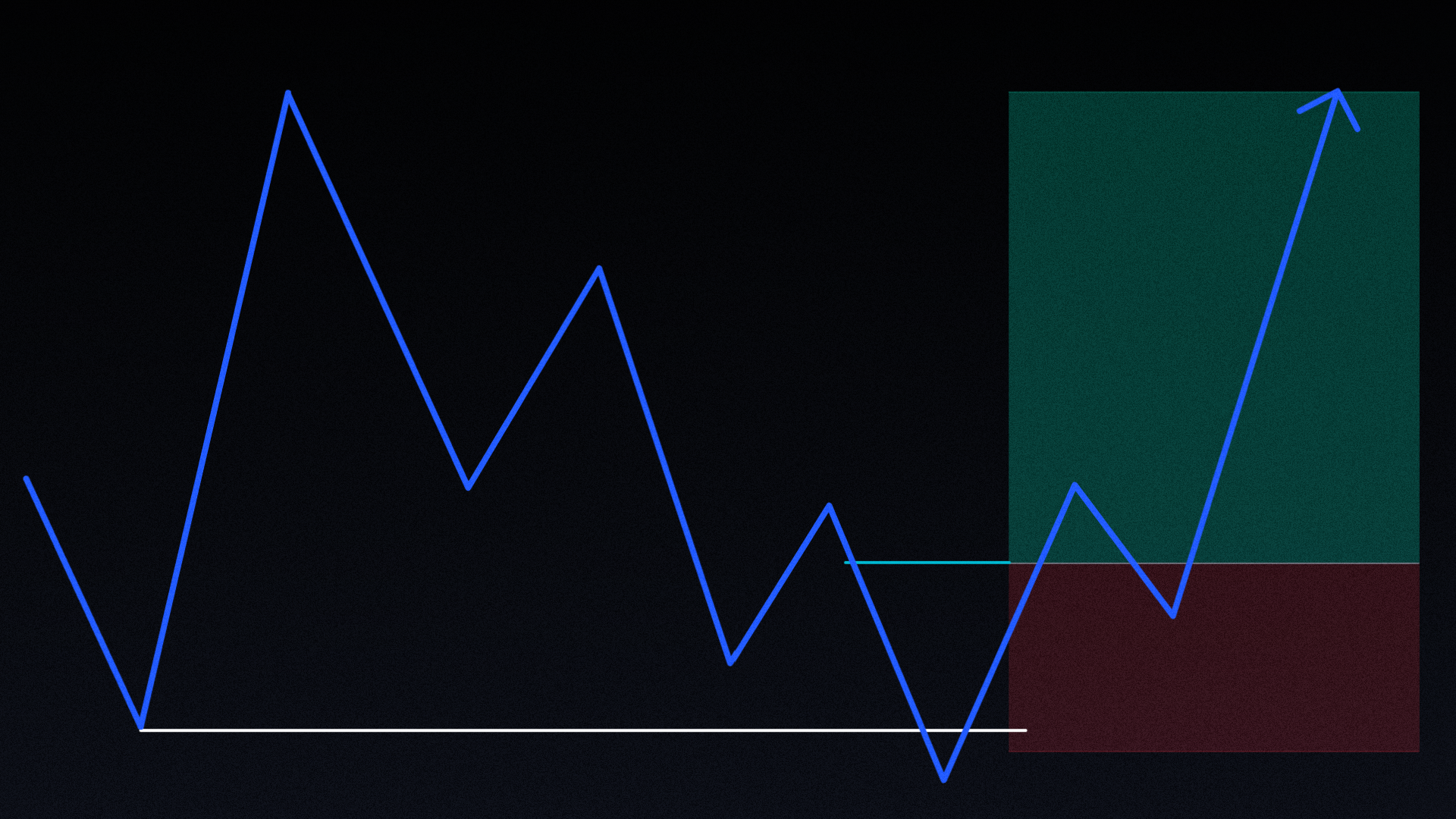

This strategy focuses on identifying trend-continuation setups on the 4-hour chart using a blend of moving averages, Fibonacci retracement levels, and price action confirmation. Traders begin by scanning for pairs with a clearly sloped 200 EMA, then wait for price to retrace and tap either the 50 or 200 EMA. A fib retracement is drawn from a recent swing high and low using the fractal indicator, and a trade setup is valid when the 0.71 level aligns tightly with the EMA tap. An entry is triggered after a reversal candle closes back above or below both the EMA and fib level.

The strategy is designed for simplicity and speed of execution, with a minimum stop loss of 10 pips, a fixed 2R target, and no trade management beyond break-even adjustments when a second trade is triggered. While fair value gaps (FVGs) are not required, they do increase setup quality. Clear invalidation and selection rules help filter out lower-quality opportunities, making this system highly suitable for structured backtesting and building confidence before trading live.

Other strategies

By

Justin Werlein

By

ICT