Justin Werlein’s Forever Model

September 12, 2025

By

Justin Werlein

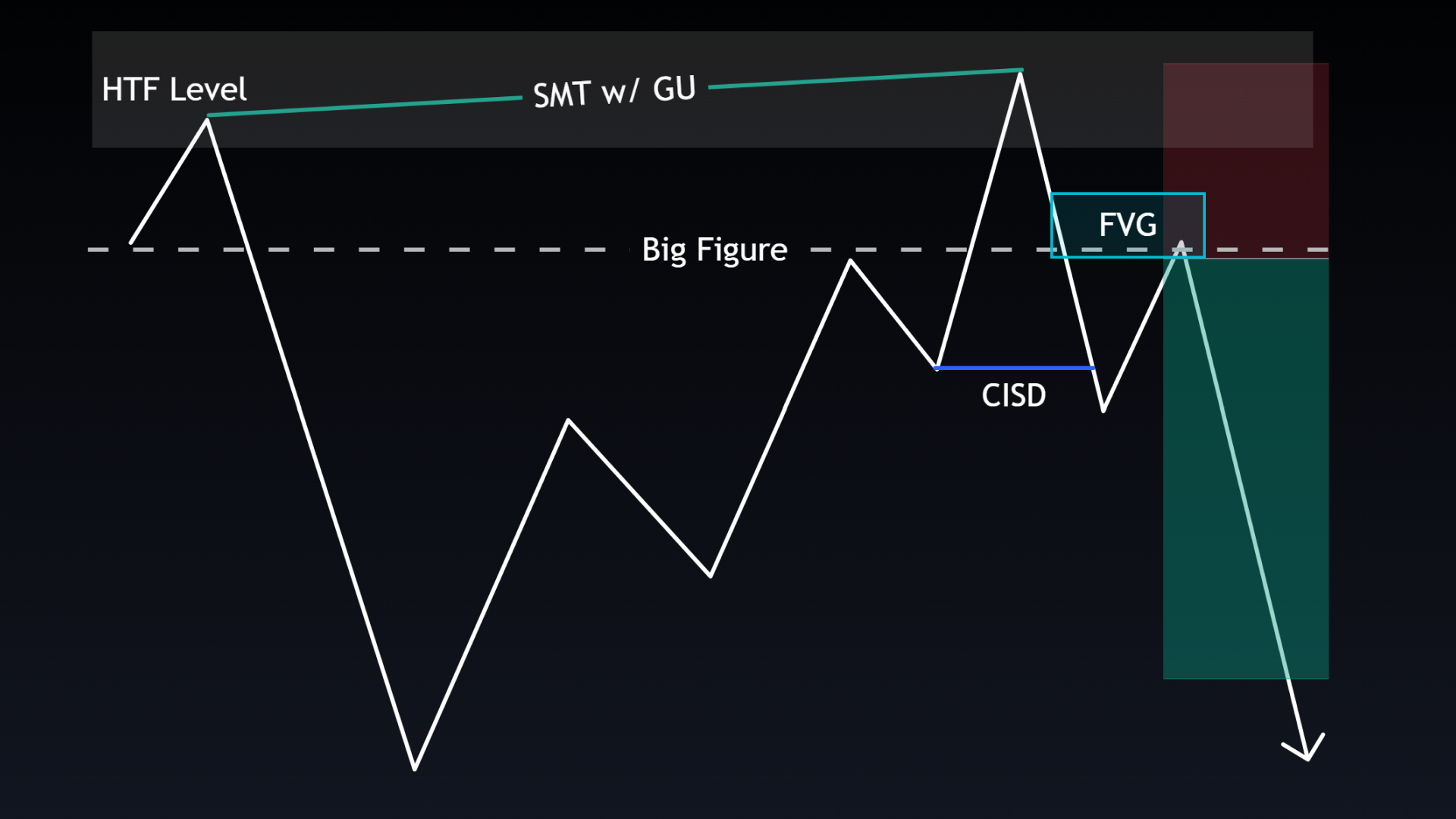

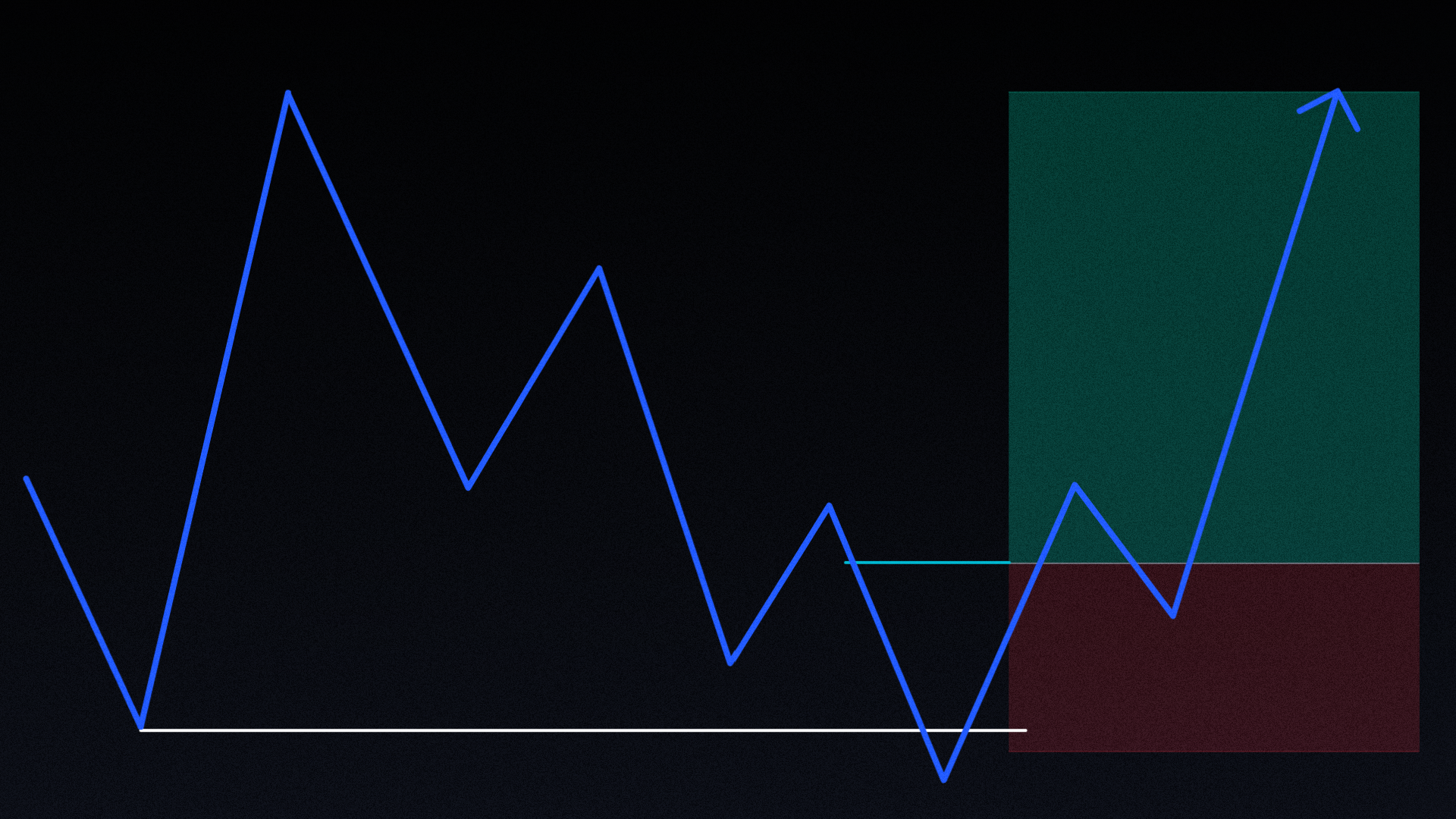

This model focuses on intraday moves in NQ and ES during the New York AM session, starting with a higher-timeframe draw on liquidity (DOL) and a 1-hour fair value gap (FVG) aligned with premium or discount zones. The bias is formed by anticipating price to pull back into the 1-hour FVG—often with inducement—before continuing toward the DOL. Confirmation comes from spotting an inverse fair value gap (IFVG) and a change in state of deliver (CISD) on the 1-, 3-, or 5-minute chart, with entries placed on a CISD retest and stops at the recent swing high/low.

Targets are projected using 2–2.5 standard deviations of the inducement leg, aiming for at least 2R, or by targeting the next internal high/low or liquidity pool. SMT divergence and V-shape momentum shifts can further strengthen the setup, while avoiding trades near high-impact news events. The approach requires patience, focusing only on high-quality setups for consistent execution.