Matt's Wicks Strategy

January 7, 2025

By

Matt from FX Replay

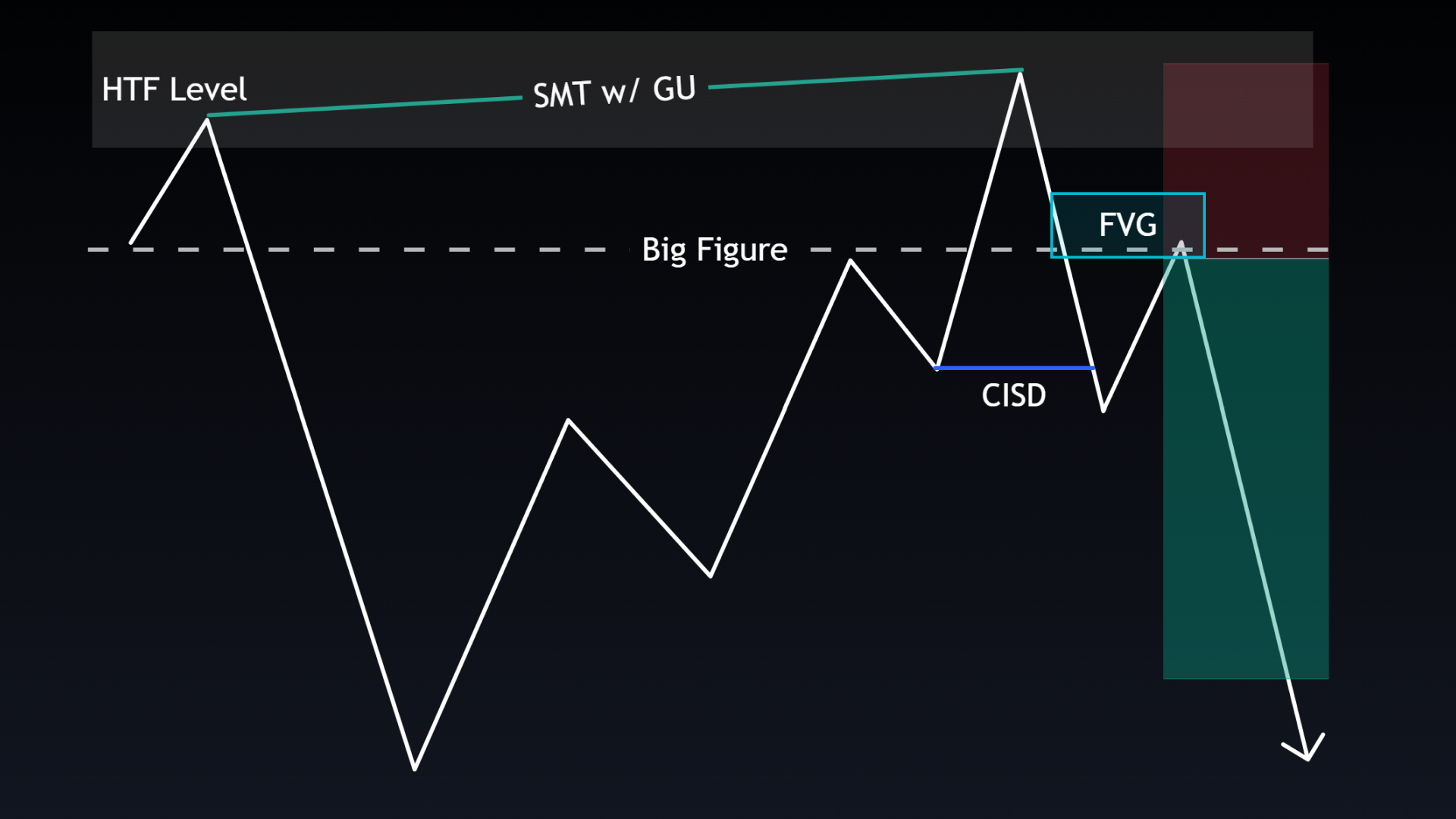

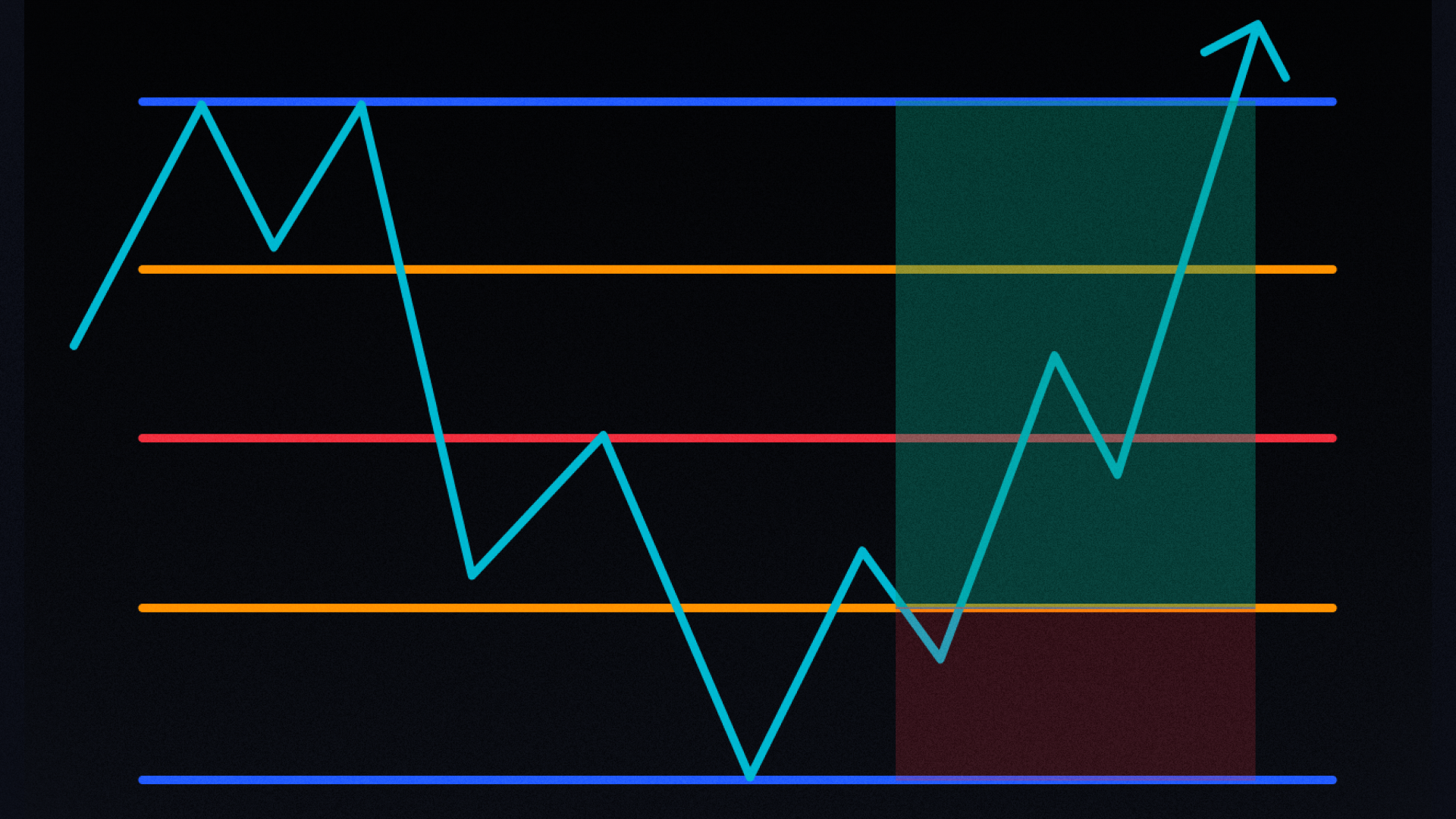

This strategy emphasizes simplicity and clarity by focusing on foundational market concepts that drive high-quality setups. Traders are guided to first understand major liquidity pools—key levels such as previous session, daily, weekly, and monthly highs and lows—where large moves often originate. Alongside these, clean legs (strong, uninterrupted candle sequences) signal momentum, while SMT divergence helps detect subtle cracks in asset correlations (like EUR/USD vs. GBP/USD) that may precede reversals. Patterns like M/W formations also hint at manipulation and liquidity grabs, especially when one correlated asset sweeps a level while the other doesn’t.

To confirm a trade setup, the model relies on technical markers like Fair Value Gaps (FVGs)—3-candle patterns with no overlapping wicks—and Change in State (CSD) events, such as structure breaks or FVG inversions. These tools, combined with HTF (higher time frame) context and levels, offer a clear roadmap from broad directional bias to precise LTF (lower time frame) entries. The core message is clear: don’t compromise on confluence—if any of these key elements are missing, the trade setup is downgraded. This structured approach encourages traders to stay disciplined and only act on setups that meet all critical conditions.

Other strategies

By

Waqar Asim

By

Ali Khan