.png)

Opening Range Break Strategy

June 14, 2025

By

Arthur Merrill

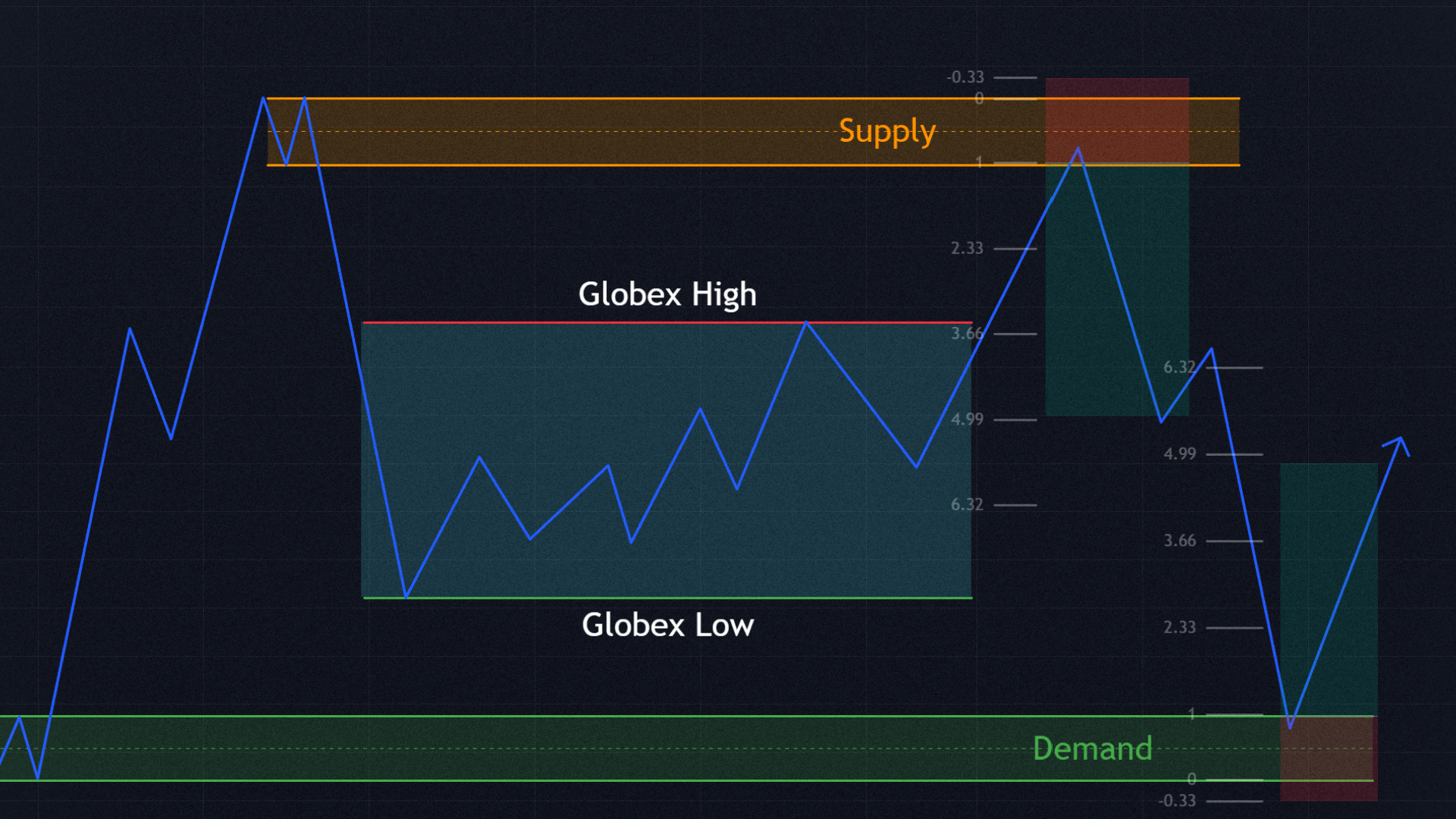

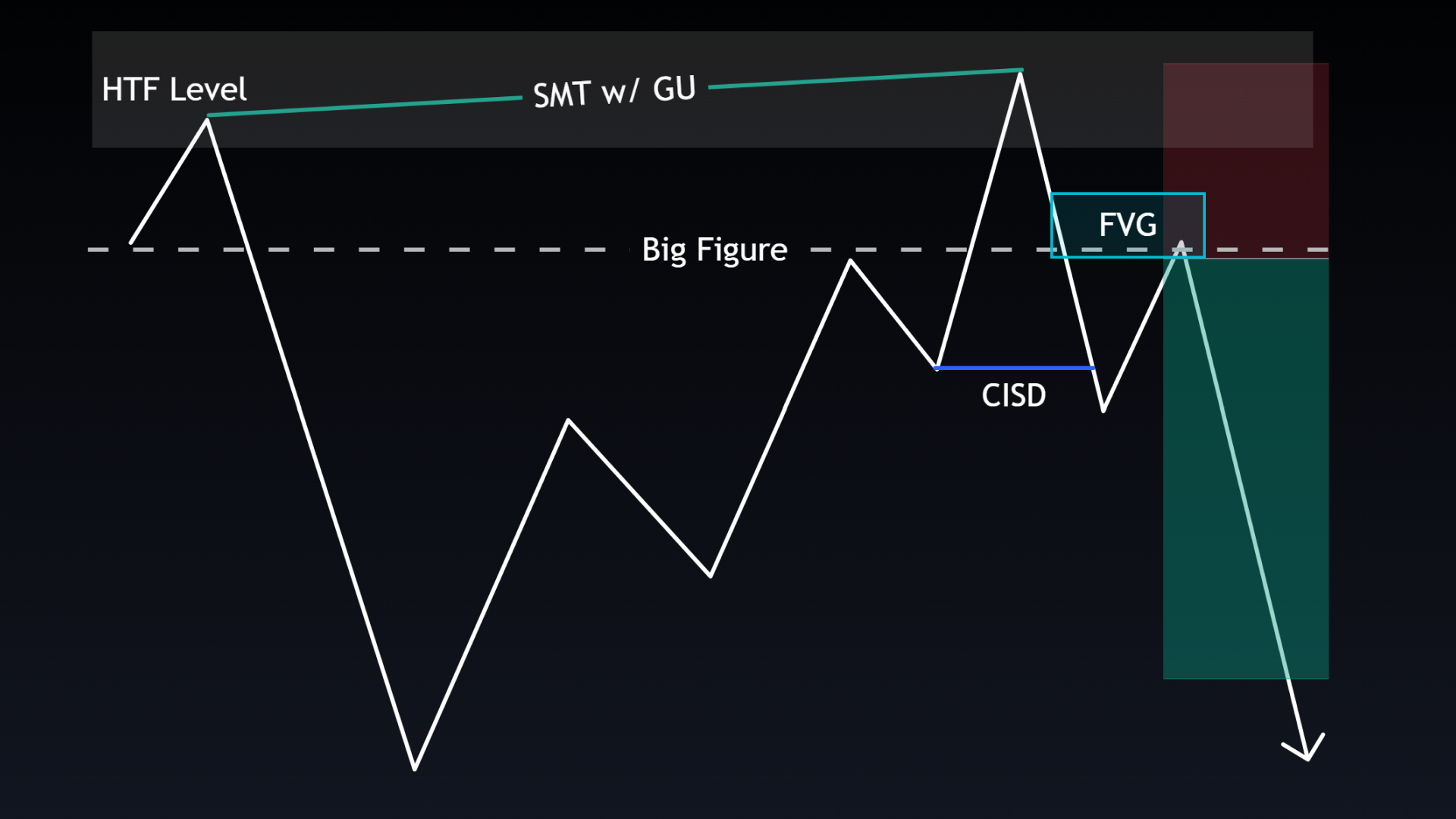

This strategy captures market cycles through three phases: Accumulation, Manipulation, and Distribution. You identify the accumulation zone based on candle bodies, not wicks, then wait for a sharp move out (the manipulation leg) and a return to the range. This pattern often precedes a large directional move as price expands away from the manipulated zone.

You can enter via a retest of an inverse FVG formed during the manipulation leg, or a bounce off the edge of the accumulation box after price re-enters it. Targets are set using standard deviations from the manipulation leg, for a minimum of 2R. The strategy becomes even stronger when paired with HTF trend direction or major liquidity sweeps, like session or prior day highs/lows. This model is best used with discipline and precise execution.