Tomtrades CBR model

January 17, 2026

By

Tomtrades

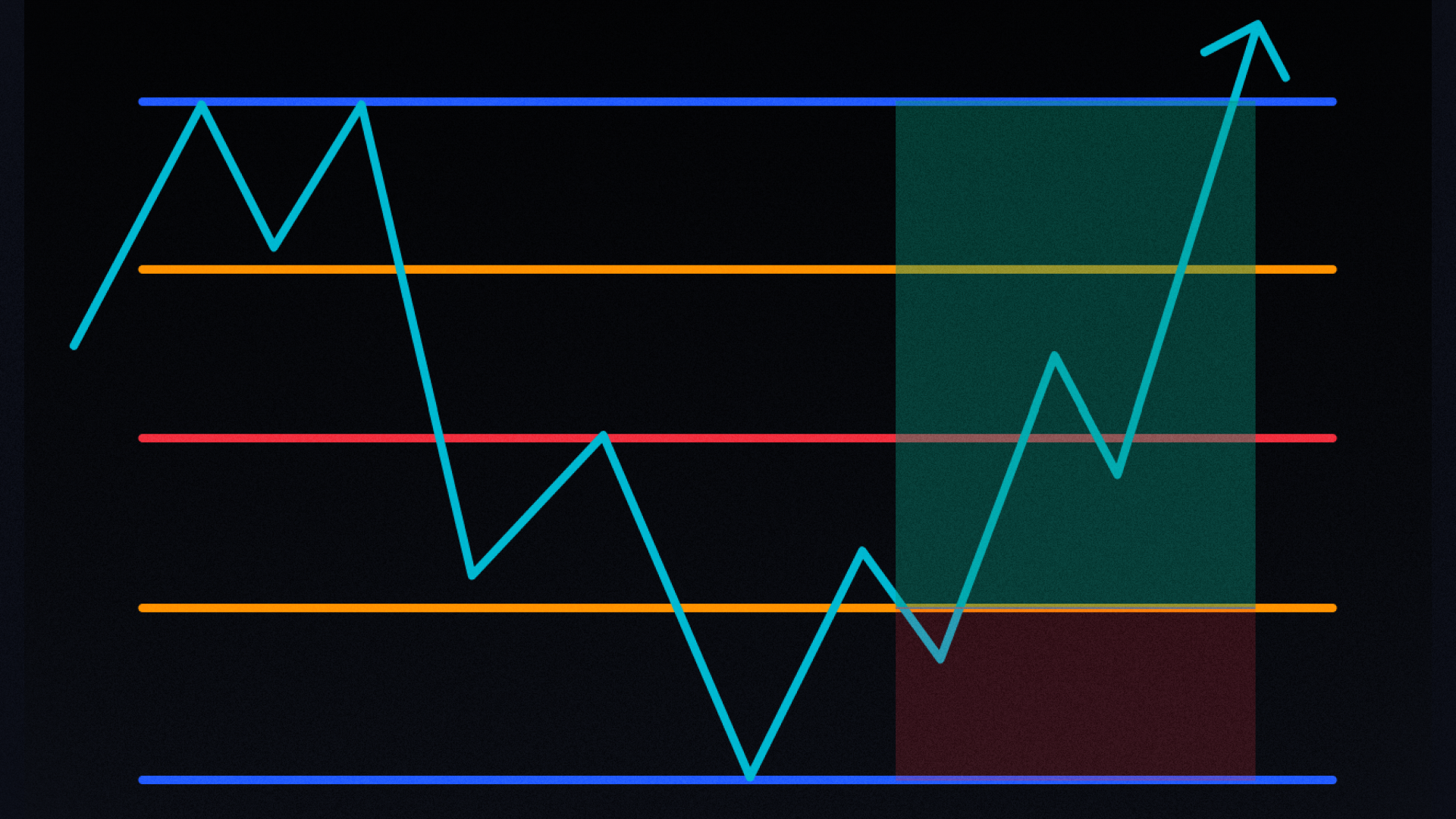

This strategy is a simplified version of TomTrades’ CBR (Candle Behavior Reversal) model, designed to make it testable and repeatable through structured rules. It uses a 1-hour timeframe to define directional bias on gold, supported by DXY inverse correlation, and executes trades on the 1-minute timeframe during a highly specific window: the second hour of the Asia session. The core idea is that strong price overextensions tend to rebalance.

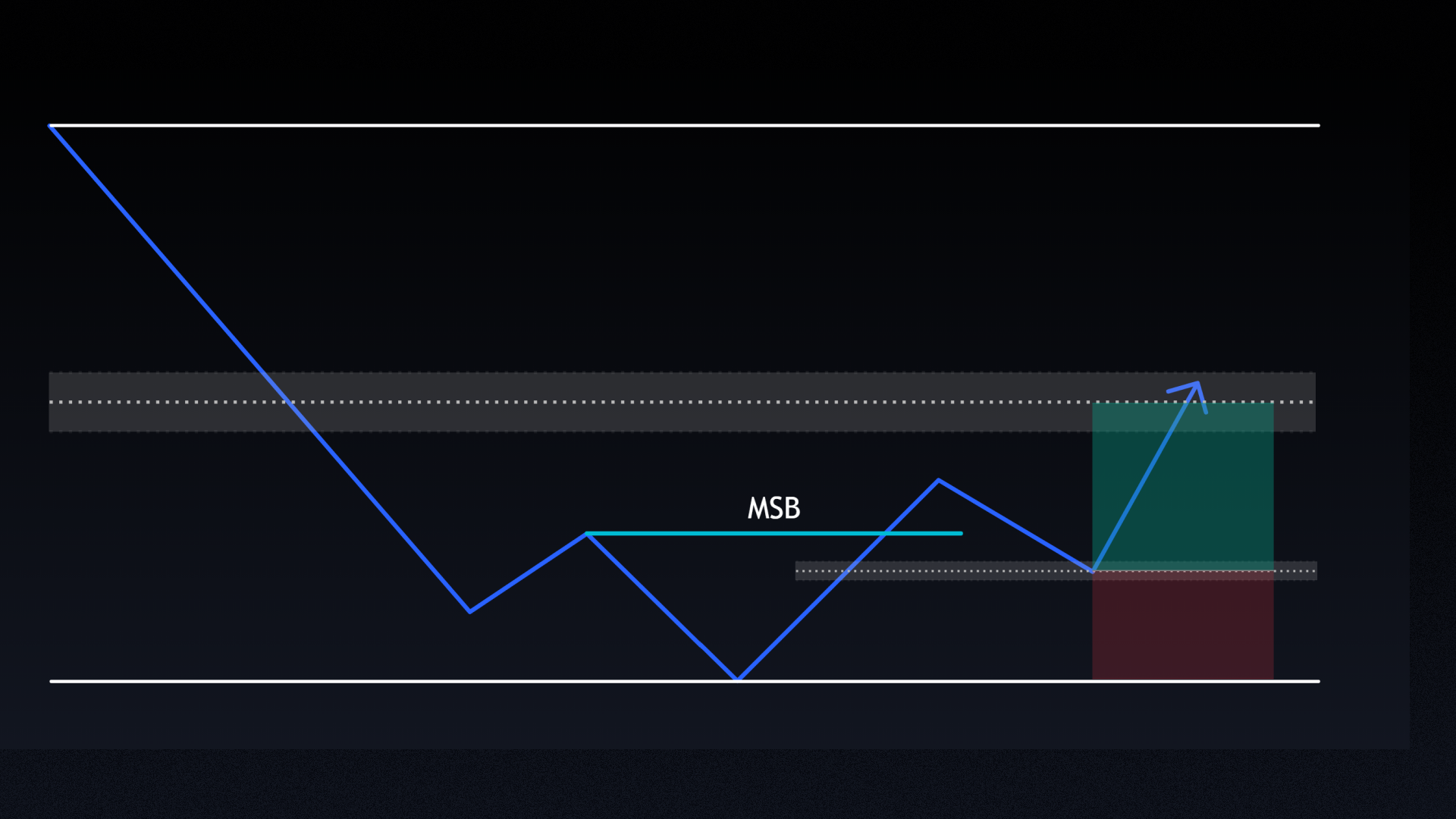

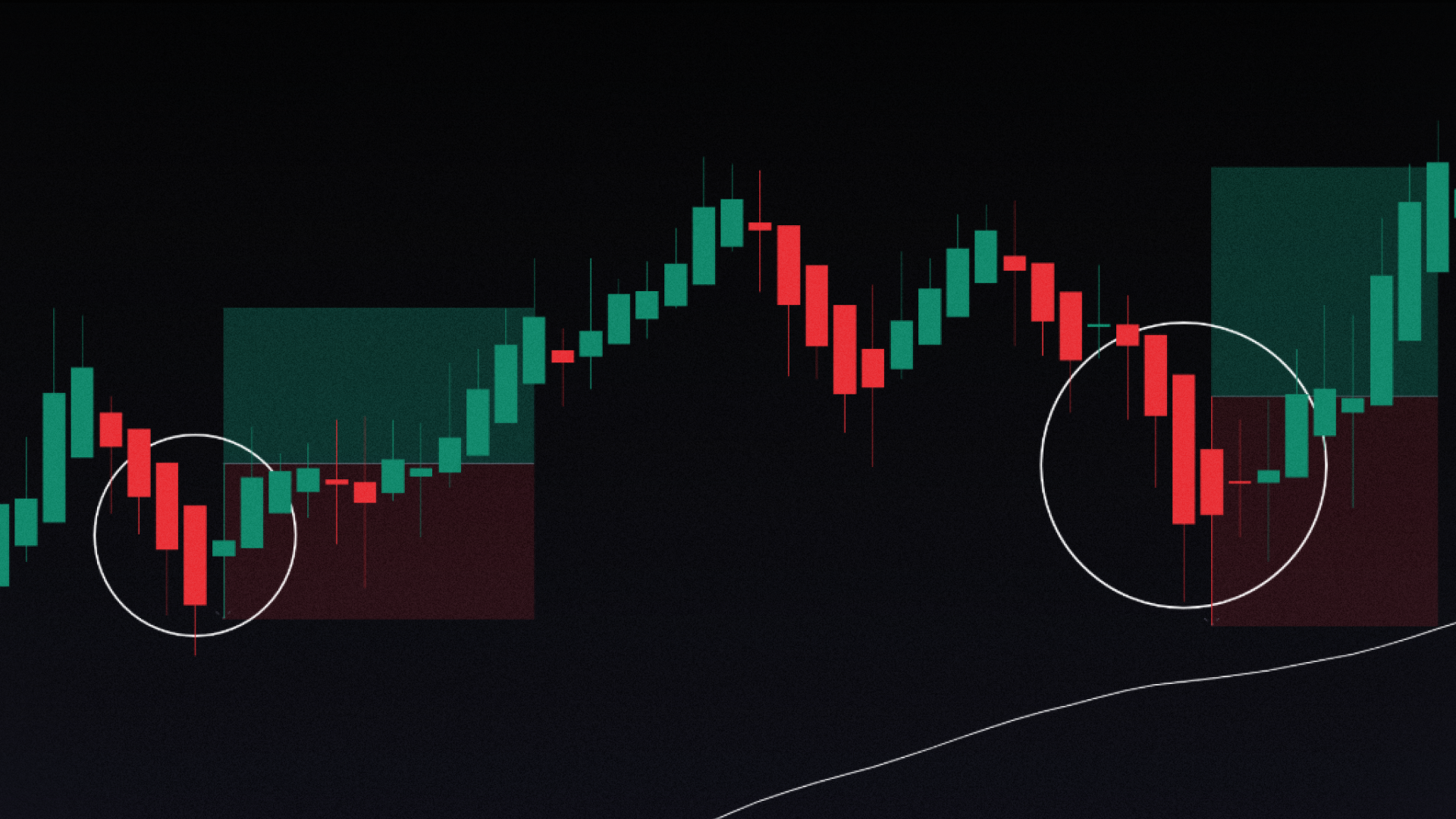

Trades are taken only after 20+ minutes of one-sided expansion, followed by either a 1-hour candle high/low sweep or a range rebalance, and then a valid Type 3 market structure shift. Entries occur near the 50% retracement of the MSB move, with stops beyond the recent high/low and targets set at equilibrium, fixed 1.5R, or extended levels when bias is strong. The model emphasizes selectivity, disciplined filtering, and repetition, making it ideal for systematic backtesting and data validation.

More videos on Tomtrades CBR Model

Other strategies

By

Ali Khan

By

Jooviers Gems