.png)

Doyle Exchange Strategy

November 9, 2024

By

Doyle Exchange

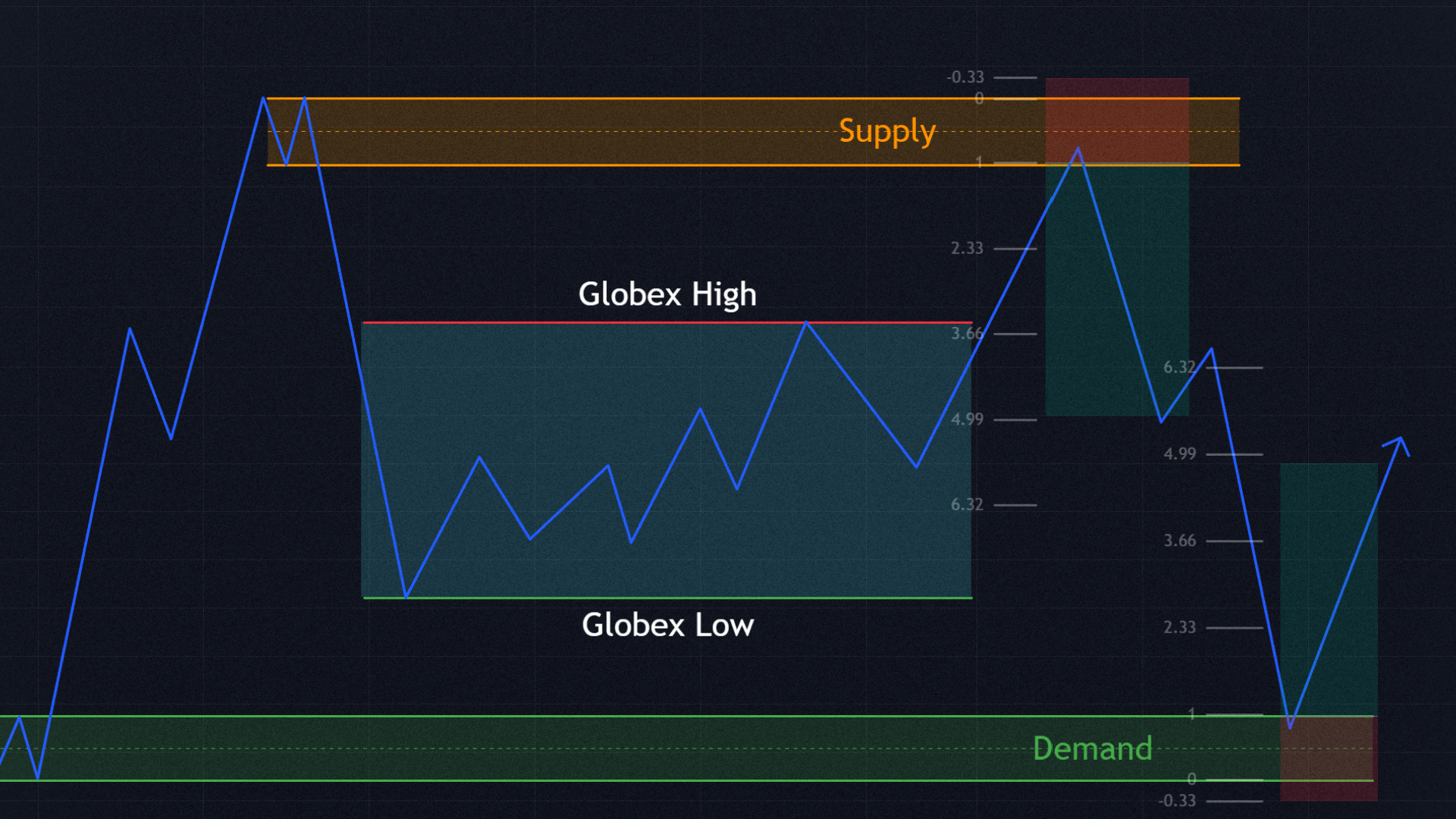

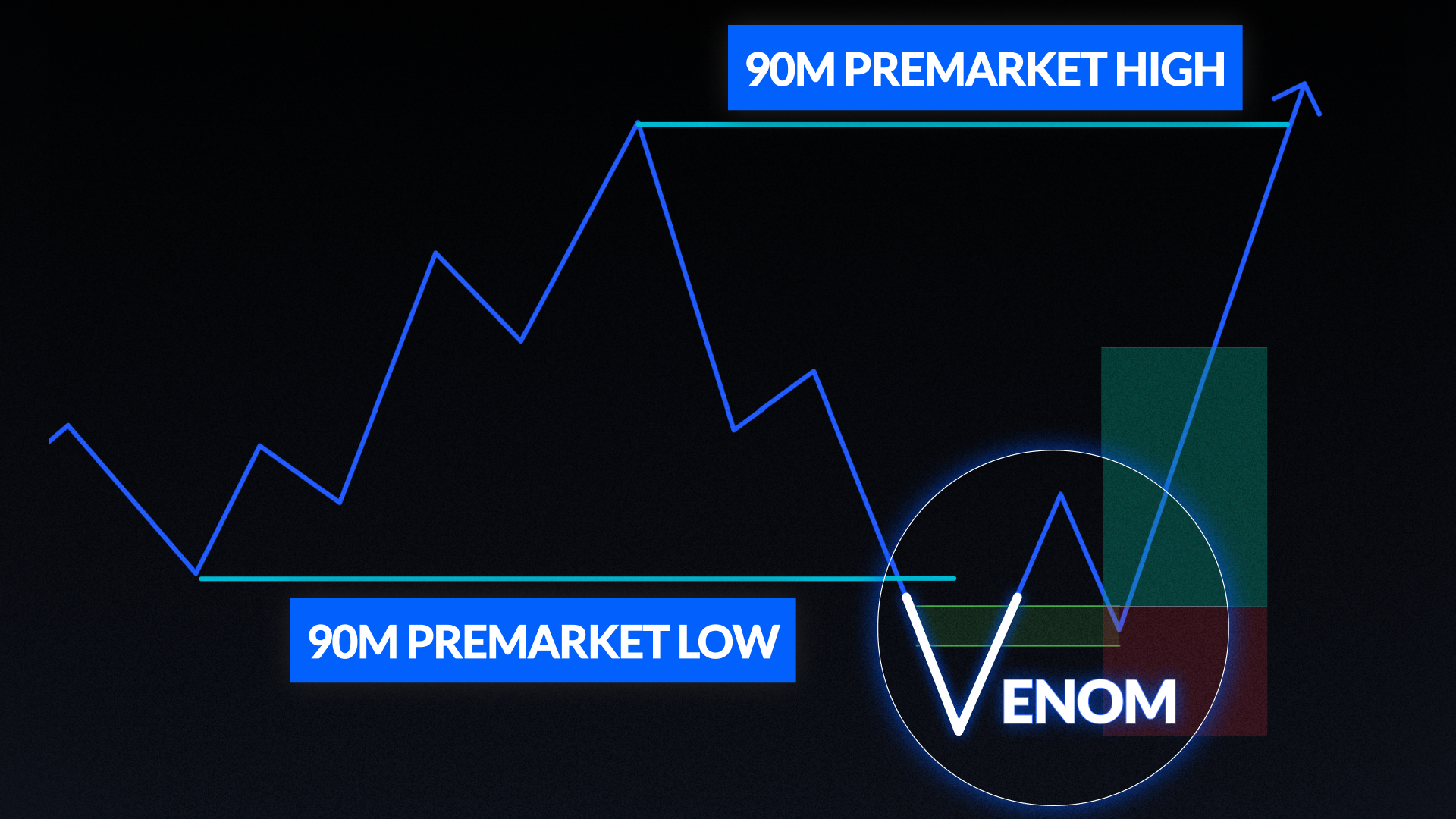

This strategy focuses on order blocks formed before impulsive moves. You define supply using the last green candle before a drop, and demand with the last red candle before a rally. Once price wicks into one of these zones—without closing inside—you prepare to trade in the direction of the 200 EMA. The method is trend-aligned, rule-based, and avoids trading reversals or chop.

Execution comes through stop orders placed just beyond the wick of the candle that tapped the zone. Aim for simple 1R targets for highest success rate. This model is especially effective when combined with break of structure and EMA confluence, which add confidence to setups. Strict checklist rules ensure you're only taking trades with clear rejection and valid trend context.