.png)

Trader Kane's NQ Strategy | El modelo de laboratorio

27 de septiembre de 2025

Por

Trader Kane

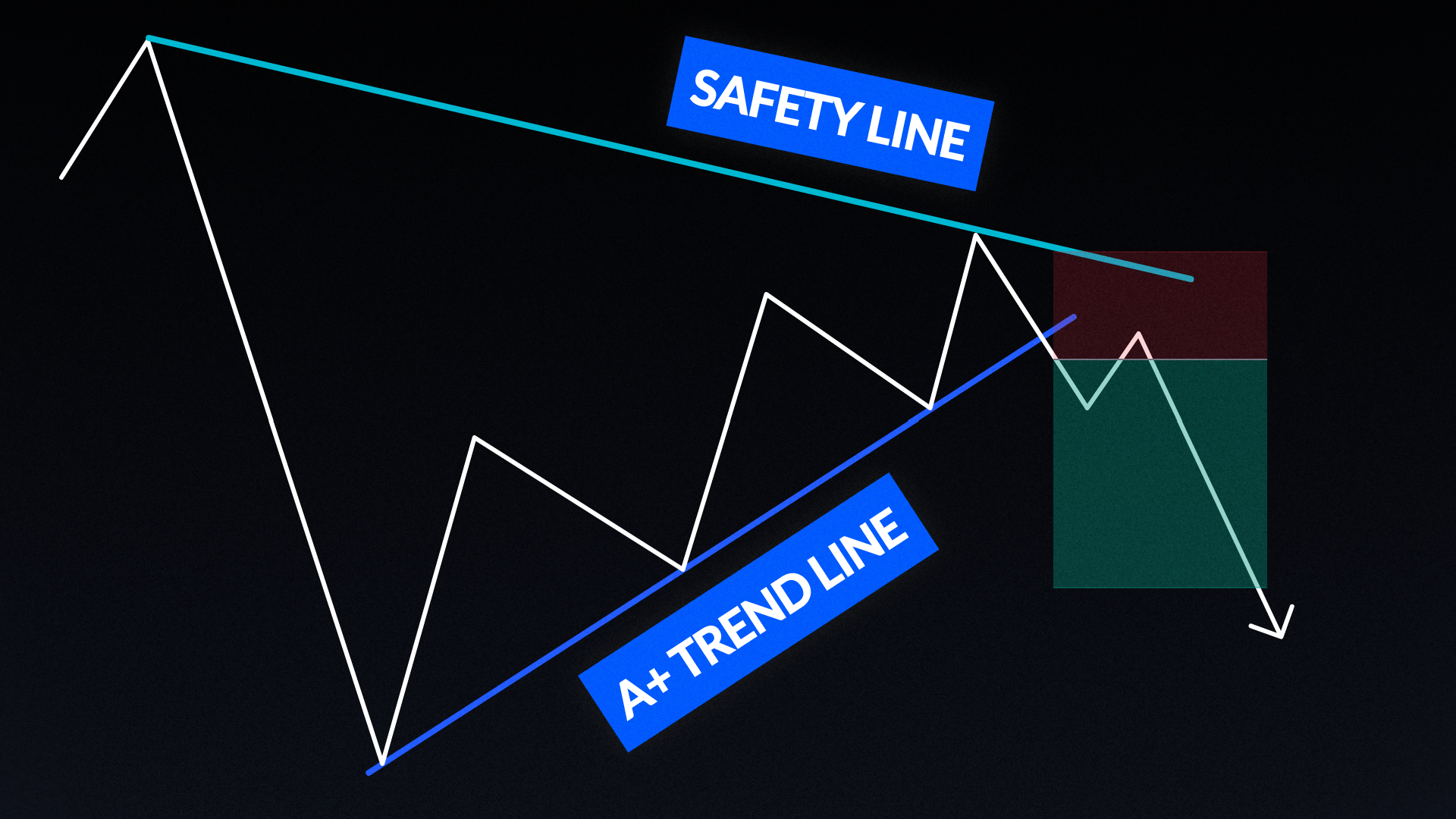

This strategy by Trader Kane revolves around precision-based intraday trading on the Nasdaq (NQ), using the S&P 500 (ES) for correlation analysis. The approach is rooted in identifying premium/discount zones across multiple timeframes (4H, 1H, 5M), with a focus on logical liquidity targets (LLTs) as profit zones. Key trade triggers include SMT divergence (a break in correlation between NQ and ES) combined with an inverted Fair Value Gap (iFVG) entry on the 1M, 3M, or 5M. Whether trading a reversal or continuation, structure and multi-timeframe confluence are central.

Reversals are triggered when the 10am 4H candle high or low is swept against the intended trade direction, followed by SMT divergence and an iFVG. Continuations require a rebalanced lower timeframe range while higher timeframes remain imbalanced, again confirmed with SMT and an iFVG. The strategy emphasizes tight risk management, trade management, and base hits over home runs. The playbook is structured and repeatable, making it an ideal fit for disciplined traders who want to accelerate their edge through backtesting.

Otras estrategias

Por

TIC

Por

Tori Oficios